Over the past 100 years, the U.S. and countries around the world have seen a massive uptick in life expectancy. Depending on the source, the world has added somewhere in the neighborhood of 15 years to life expectancy in the last 60 years alone. And while life expectancy may have fallen due to the pandemic and other related factors, on a macro view, we’re still living longer than ever.

It’s fairly easy to surmise why this is the case. The advancement in medical technology and pharmaceuticals has cured many ailments that were a death sentence even 30 years ago. And while everyone has benefited from these improvements, the picture is even better for women. The Society of Actuaries suggests that a 65-year-old woman today has a 46% chance of living to 90.

Longevity and Healthcare Costs

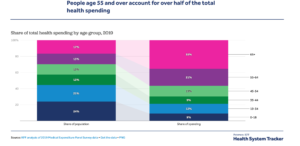

Longevity impacts every piece of your clients’ financial puzzle. There will almost certainly be ongoing health expenditures and potential long-term care expenses as well. Those above 65, while a smaller portion of the population, account for 35% of healthcare spending in the US.

What does this mean for your practice? As you can likely ascertain, it means that your clients will likely need additional resources than the generation before them. Of course, your clients aren’t working with you to just “not run out of money”. Most of your clients want to live well and continue to reach for the goals that they’d like to accomplish. Traveling, purchases, meeting familial needs, legacy building and so much more keep our minds and our souls strong.

Your clients, with your guidance, have to decide on a sustainable monetary strategy. Running scenarios and being ready to show them options during your conversation with them, means you’ll want to use a financial planning tool that is flexible, modern and affordable.

Are you happy with your current financial planning tool? What would you change if you could? Our team vets and integrates financial planning software for our RIAs. If you’re tired of using antiquated software, maybe it’s time to explore partnering with tru Independence so that both you and your clients can build the future you want.